how to avoid estate tax in california

So before you start looking for ways on how to avoid paying California state income tax you should know how California determines its residency. Potentially pay 0 in Capital Gains.

To A B Or Not To A B That Is The Question Botti Morison

The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated California commercial property owner.

. Chat With A Trust Will Specialist. Built By Attorneys Customized By You. There are several ways to accomplish this.

Instead of gifting money to get it out of your estate you could use. With careful planning gifting can be an excellent way to avoid probate and simplify your estate. Reduction in Property Tax Revenues.

Your heirs pay the estate tax on the balance of your estate. If your estate will be subject to capital gains after your death you can use permanent life insurance to pay those taxes. California has State Income Tax Property Tax and Sales Tax.

The gift tax exemption threshold is 15000 in 2021. The surest way to avoid or. One way to avoid probate in California is to use a living.

1 Federal State and Inheritance Tax on House Rules Explained. How To Avoid Estate Tax With Life Insurance. If you want to avoid estate taxes you could create an irrevocable trust and transfer the ownership of your property into the trust.

If you plan to gift your real estate to your children or grandchildren start planning now to avoid leaving them with a large property tax burden. Ad Learn about Opportunity Zones. 2 How to Avoid Inheritance Tax and Capital Gains.

12 What about capital gains tax. Not own property and 3. Urban catalyst is a leader in Opportunity Zone investing.

California residents dont need to worry about a state inheritance or estate tax as its 0. Move to another state. Ad Fisher Investments has 40 years of helping thousands of investors and their families.

We estimate that in 201516. What Are the Legal Options to Avoid Estate Tax in California. However the federal gift tax does still apply to residents of.

If you spend more than 9 months in the. California property tax planning and more specifically avoiding reassessment of property taxes has never been more important. Not buy anything OR 4.

Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. How to avoid the New York estate tax cliff Outlining in your will or revocable trust exactly how your assets should be handled makes your estate executors job much easier. In addition to property tax if you.

Charitable contributions can also reduce the value of your estate and help you reduce or avoid estate taxes. There are a myriad of others. 11 Inheritance tax vs estate tax.

How to Avoid California Property Tax Reassessment. Potentially pay 0 in Capital Gains. So to avoid California taxes you should.

Ad Learn about Opportunity Zones. No California estate tax means you get to keep more of your inheritance. There are a few ways individuals can protect their beneficiaries from inheritance tax.

In some cases an executor might just have a different alternate. California estates must follow the federal estate tax which taxes certain large. Blessed is the hand that gives indeed.

Give to charity while. Urban catalyst is a leader in Opportunity Zone investing. Apply for permanent life insurance.

Consider the alternate valuation date. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. So if you have an 18 million estate you can gradually pass on your assets to your loved ones until the net value of your estate is less than or equal to 1206 million.

California does not levy a gift tax. Is there a way to avoid inheritance tax. The widespread use of the inheritance exclusion has had a notable effect on property tax revenues.

You will no longer.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

California Estate Tax Everything You Need To Know Smartasset

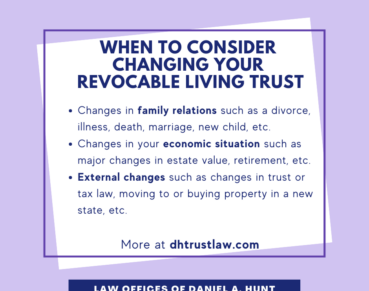

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Colorado Estate Tax Everything You Need To Know Smartasset

Distributable Net Income Tax Rules For Bypass Trusts

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Taxes On Your Inheritance In California Albertson Davidson Llp

Taxes On Your Inheritance In California Albertson Davidson Llp

California Durable Power Of Attorney Form Power Of Attorney Form Power Of Attorney Attorneys

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

California Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die