south dakota used vehicle sales tax rate

Including local taxes the South Dakota use tax can be as high as 2000. The South Dakota sales tax and use tax rates are 45.

In addition for a car purchased in South Dakota there are other applicable fees including.

. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. Mobile Manufactured homes are subject to the 4 initial registration fee. Web If a state with no tax or a lower tax rate than South Dakotas 4 then you will need to pay the additional tax rate to match the 4.

What Rates may Municipalities Impose. Web South dakota used vehicle sales tax rate. The december 2020 total local sales tax rate was also 6500.

The South Dakota use tax rate is 4 the same as the regular South Dakota sales tax. South Dakota has recent rate. Web The South Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into South Dakota from a state with a lower sales tax rate.

Average Sales Tax With Local. Counties and cities can charge an additional local sales tax of up to. Web Car sales tax in South Dakota is 4 of the price of the car.

Counties and cities can charge an additional local sales tax of up to 2 for a. Web 31 rows The state sales tax rate in South Dakota is 4500. With local taxes the total sales tax rate is between 4500 and 7500.

Web South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. Web You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. Web Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

Its important to note that this does include any local or county sales tax which can go up to 35 for a. The south dakota dmv registration fees youll owe. Web South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

You have 90 days from your date of arrival to title and license your vehicle in South Dakota. Web South dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. Web What is South Dakotas Sales Tax Rate.

Can I import a vehicle into South Dakota for the lone purpose of repair or modification. South Dakota municipalities may impose a. Web Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax.

Web The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

Does South Dakota Have A State Income Tax Dakotapost

What S The Car Sales Tax In Each State Find The Best Car Price

South Dakota Sales Tax Small Business Guide Truic

Sales Use Tax South Dakota Department Of Revenue

South Dakota Estate Tax Everything You Need To Know Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

Minnesota Sales Tax Calculator And Local Rates 2021 Wise

All Vehicles Title Fees Registration South Dakota Department Of Revenue

What S The Car Sales Tax In Each State Find The Best Car Price

How Much Does Your State Collect In Sales Taxes Per Capita

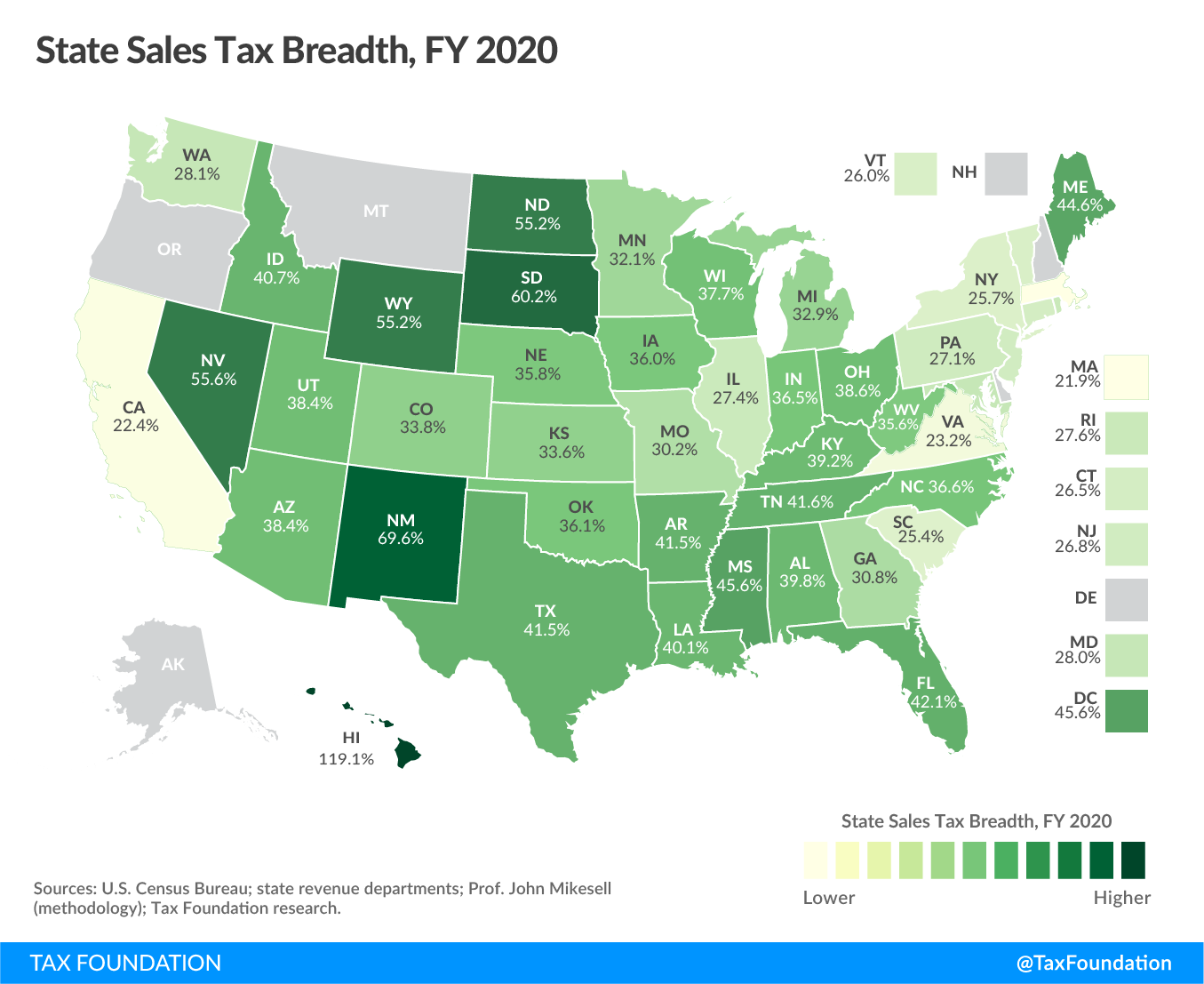

State Sales Tax Base And Reliance Fy 2020 Tax Foundation

States With No Sales Tax On Cars

Used Vehicles For Sale 1920 North Ave Spearfish South Dakota 57783 Prestige Auto Sales

New York Sales Tax For Your Auto Dealership

Sales Use Tax South Dakota Department Of Revenue

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)